3 Important Takeaways From GM’s Strong Q1

Tariffs could eat billions from automakers’ bottom lines

The automotive industry is facing a significant challenge as tariffs imposed by the Trump administration threaten to impact the bottom lines of automakers. The 25% levy on imported vehicles and automotive parts, which is set to extend to imported parts in May, has raised concerns about the potential financial impact on companies in the sector. General Motors, one of the leading automakers, recently reported a strong first quarter, surpassing analysts’ estimates. However, the company has taken a cautious approach by suspending further share repurchases and withdrawing its guidance.

The uncertainty surrounding tariffs has put automakers in a difficult position, with analysts predicting a wide range of impacts on profits. The potential impact of tariffs on GM’s operating income could be as high as 100%, underscoring the seriousness of the situation. In response to this uncertainty, General Motors has decided to reassess its guidance and withhold further share repurchases until there is greater clarity on the issue.

Despite the challenges posed by tariffs, there is some optimism in the industry. Reports suggest that the Trump administration may soften the impact of automotive tariffs, providing some relief to automakers. General Motors believes it can offset a significant portion of North American tariffs, offering a glimmer of hope amid the uncertainty.

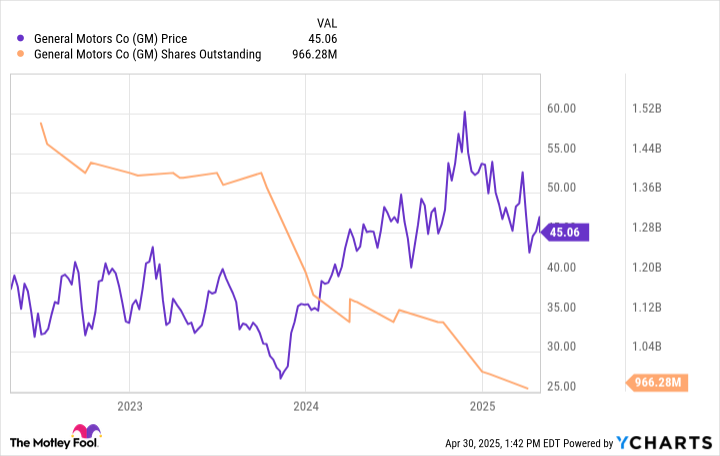

One area where General Motors has excelled in recent years is its share buyback program. The company has been actively repurchasing its undervalued shares, signaling confidence in its long-term prospects. While the suspension of further buybacks may be disappointing, GM’s decision to maintain its dividend, and even increase it, demonstrates its commitment to shareholders.

In conclusion, while tariff uncertainty continues to loom over the automotive industry, General Motors remains well-positioned to weather the storm. The company’s strong performance in core segments, such as SUVs, trucks, and luxury vehicles, provides a solid foundation for future growth. Investors considering General Motors stock should weigh the potential impact of tariffs against the company’s resilient business model and long-term prospects.

For more insights on investing in the current market climate, consider consulting with financial experts or exploring opportunities with reputable investment platforms. Stay informed and make informed decisions to navigate the challenges and opportunities in the ever-evolving automotive industry.