Analysts react to US-China trade agreement

After intense negotiations, U.S. and Chinese officials have announced a framework to move forward with their trade truce and address longstanding trade disputes. The agreement includes the removal of China’s export restrictions on rare earths, a crucial move that could have far-reaching implications for both countries.

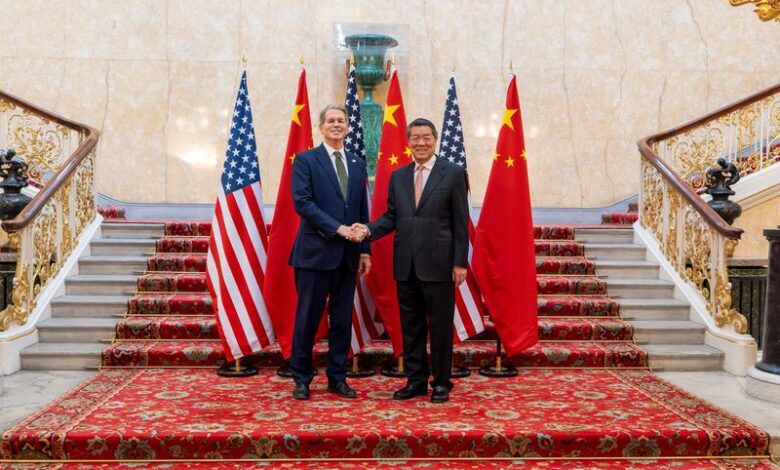

China’s Vice Commerce Minister, Li Chenggang, confirmed that both teams have agreed to implement the Geneva consensus and bring the agreed framework back to their respective leaders. This development marks a significant step towards resolving the trade tensions between the two economic powerhouses.

A White House official revealed that the deal allows the U.S. to impose a 55% tariff on imported Chinese goods. This includes a baseline reciprocal tariff of 10%, a 20% tariff for fentanyl trafficking, and a 25% tariff reflecting pre-existing tariffs. In return, China will charge a 10% tariff on U.S. imports.

The market reaction to this news has been somewhat muted, with equity markets and the dollar showing minimal movement. The S&P 500 saw a slight increase of 0.1%, as investors await more details on the agreement and its potential impact on the global economy.

Financial experts have offered their insights on the implications of this trade deal. Gene Goldman, Chief Investment Officer at Cetera Investment Management, expressed cautious optimism about the news, highlighting the need for more information on what China gains in return for the concessions made.

Sam Stovall, Chief Investment Strategist at CFRA Research, noted that the market’s response to the deal was relatively subdued, indicating a sense of indifference. He emphasized the importance of a comprehensive solution to the trade disputes to avoid further disruptions in the market.

Oliver Pursche, Senior Vice President at Wealthspire Advisors, highlighted the need for more details on the agreement, suggesting that the market’s lack of reaction may be due to the uncertainty surrounding the deal’s implementation.

Overall, while the initial announcement of the trade deal has generated some optimism in the market, there is still a sense of caution among investors regarding the long-term implications. The details of the agreement, as well as the willingness of both parties to adhere to the terms, will play a crucial role in determining the success of this trade truce. As the world watches the developments between the U.S. and China, the global economy remains on edge, waiting to see how this framework will unfold in the coming months.