Consumers Show Signs of Strain Amid Trump’s Tariff Rollout

The U.S. consumer has seemed unstoppable in recent years, spending throughout soaring inflation and the highest borrowing costs in decades. That resilience helped to keep at bay a recession that many thought inevitable after the pandemic.

Consumer spending has fueled the economy

Year-over-year percentage change in retail and food service sales

President Trump’s tariffs and their scattershot rollout have once again raised concerns that the United States may soon face an economic downturn. While the odds of an outright recession have fallen as the highest levies have been paused, there are reasons to be worried about the ability of consumers to continue to prop up growth.

Consumer spending accounts for more than two-thirds of U.S. economic activity, meaning a sharp enough pullback could cause significant damage.

For now, consumers are still spending, although more slowly than in the past. Their attitudes about the economic outlook have soured in recent months in anticipation of elevated prices, slower growth and higher unemployment. Americans have also become choosier about how they spend their money. Leisure and business travel has declined. People are buying fewer snacks and eating out less as they look to cut costs. They are even doing fewer loads of laundry to save money.

“The economy is really vulnerable to anything that could go wrong, and clearly there’s a lot that could go wrong,” said Mark Zandi, chief economist of Moody’s Analytics.

It is not yet clear if the slowdown simply reflects distortions related to stockpiling before Mr. Trump’s trade war starts to really bite, or if it is an early sign of a full-blown retreat.

Part of what has enabled consumers to spend so freely up until this point is a stockpile of savings that they accrued as a result of government stimulus during the pandemic and a booming stock market. Those savings have now largely been tapped out.

“The cushion that was there during the pandemic to weather the storm of higher prices is not there now,” Diane Swonk, the chief economist at KPMG, said. The highest-earning 10 percent of Americans, who drive the bulk of consumer spending, are still in good shape, but it’s the bottom 90 percent that worry her most.

Those households are under increased financial stress.

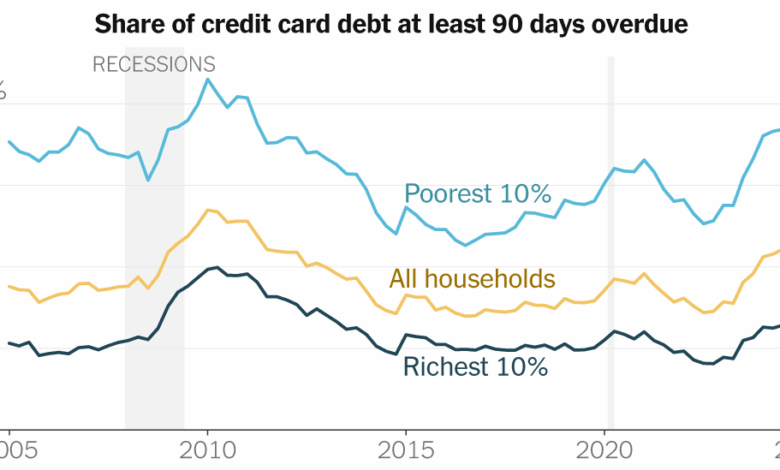

The share of outstanding credit card debt that is 90 days or more past due started increasing in 2023 and has continued to rise across geographies and income levels, according to data through the first quarter of this year released Tuesday by the New York Fed and research by the St. Louis Fed. The trend has become particularly pronounced for poorer households.

Credit card delinquency is high

Percentage of credit card debt that is 90 days or more past due

And real-time credit reports from Experian, one of the three major U.S. credit rating firms, suggest the pace accelerated in April.

Americans are struggling with other kinds of payments, too. The overall delinquency rate, which includes all loan types, reached its highest level since 2020 in the first quarter of this year, according to the Fed data. This was driven by student loan delinquencies, as past-due student loans once again were included in credit reports after a pandemic-era pause on federal student loan repayments.

Because they now have to pay down those balances after a five-year reprieve, consumers may increasingly have trouble servicing other kinds of loans, another strain.

What matters most, however, is the labor market. “If American consumers have money, they’re going to spend it, and the primary place they get money is through their jobs,” said Eric Winograd, an economist at the investment firm AllianceBernstein.

Businesses are still hiring, layoffs are low and the unemployment rate has stabilized at a historically low level of around 4 percent. But the labor market is noticeably less robust than it was in the aftermath of the pandemic, a period that was marked by booming hiring, soaring wages and acute worker shortages.

“Nothing emboldens consumers quite like a strong labor market, and we don’t have that anymore,” said Tom Porcelli, chief U.S. economist at PGIM Fixed Income.

Companies are posting far fewer job openings and positions are no longer much more plentiful than the number of people looking for work as businesses reassess their staffing needs in an environment of slowing growth.

Jobs are no longer much more plentiful than available workers

Job openings vs. unemployment

Spending is now consistently increasing faster than income, once adjusted for inflation. This imbalance cannot last, said Neil Dutta, head of economic research at Renaissance Macro. Either incomes will need to accelerate or consumption must slow over time.

The expert mentioned that with the current job market and wage growth trends, it is more probable for consumer spending to slow down rather than incomes to increase. This suggests that people may have less disposable income to spend on goods and services.

It is observed that wage growth has decelerated, especially for employees in low-wage industries. This contrasts with the initial recovery period when workers in sectors like leisure and hospitality experienced a surge in earnings. Currently, higher-wage industries are witnessing faster pay rises while lower- and mid-wage job sectors are experiencing stagnant pay levels.

The impact of the post-pandemic era on consumer behavior remains uncertain. Consumers are facing increased financial pressure, but it is unclear whether they will struggle under this burden or find ways to overcome it.

Federal Reserve policymakers seem to be cautiously monitoring the economic repercussions of recent policies before considering any interest rate adjustments. Despite the challenges, there is confidence in the resilience of the U.S. consumer, as noted by John Williams, the president of the Federal Reserve Bank of New York, who expressed faith in the consumer’s ability to navigate through tough times. following sentence using different words:

Original: The cat sat lazily in the sun, grooming itself with its tongue.

Rewritten: The lazy cat lounged in the sunlight, grooming itself with its tongue.