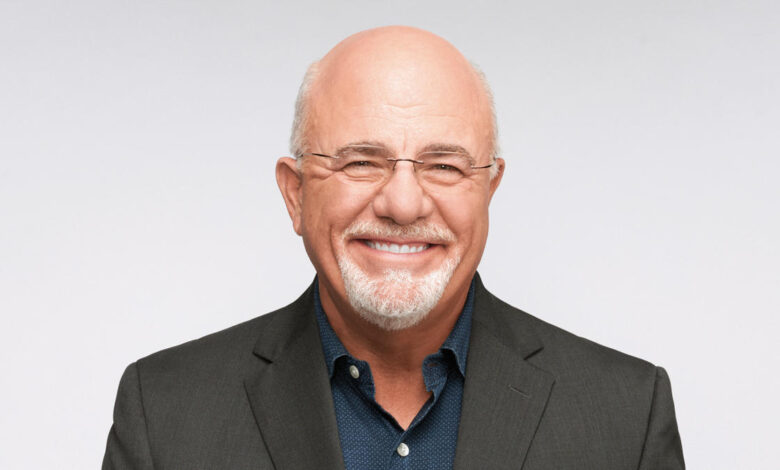

Dave Ramsey’s Top 6 Tips for Getting Richer

Getting rich may seem like an unattainable goal, especially for those in the middle class. However, the strategies for building and maintaining wealth remain consistent regardless of your financial status. Renowned financial expert Dave Ramsey has shared his top six tips for getting richer in one of his blog posts, and below, we will delve into his wealth-building advice.

One key way to generate more investable money is to either increase your income or lower your expenses. Ramsey emphasizes the importance of increasing your income as a top strategy for building wealth. By working to boost your income, you can create additional funds to allocate towards your wealth-building goals. This can be achieved through various means, such as negotiating for a raise at work or starting a side hustle to bring in extra cash.

On the other hand, lowering your expenses is another effective way to create more free cash flow. Ramsey recommends cutting out unnecessary expenses from your budget and focusing solely on essentials. This could involve meal planning to save on groceries, cancelling unused streaming services, and being mindful of energy usage to reduce utility costs.

Another crucial tip for growing richer is to eliminate debt. Ramsey believes that using this month’s income to pay off debt from the past hinders your ability to take full advantage of wealth-building opportunities. By clearing your debts, you can free up your income and utilize today’s money to work towards building wealth.

Building an emergency fund is also essential in your journey to financial stability. By having a safety net in place to cover three to six months of living expenses, you can avoid financial crises and stay on track with your wealth-building plans. In the event of unexpected expenses, you can tap into your emergency fund instead of taking on more debt.

Ramsey suggests investing 15% of your gross household income as a smart way to grow your wealth. This can be achieved through various accounts such as an employer’s 401(k), a Roth IRA, an HSA, and a brokerage account. However, you can simplify this process by focusing on increasing your contributions to your employer’s 401(k) until you reach the 15% mark.

In a world inundated with influencers and financial “gurus” promoting get-rich-quick schemes, it’s important to steer clear of trendy scams. Ramsey advises against falling for these gimmicks and instead emphasizes the value of sticking to tried-and-true strategies, such as making consistent contributions to the stock market. Remember, building wealth is a long-term process that requires patience and diligence.

By following these tips from Dave Ramsey, you can set yourself on the path to financial success and work towards achieving your goals of building wealth. Remember, the key lies in increasing your income, reducing expenses, eliminating debt, building an emergency fund, investing wisely, and avoiding quick-fix schemes. Stay focused on your financial objectives and watch your wealth grow over time.