Health insurance coverage losses under House GOP tax, spending bill

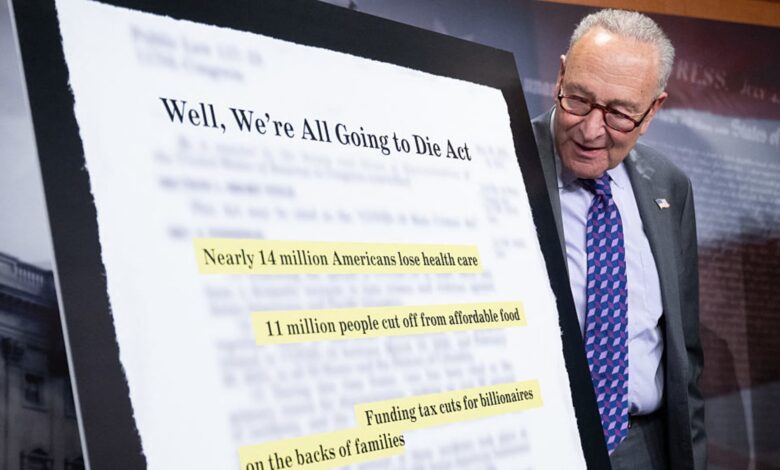

The House tax and spending bill has caused significant concern among experts, who predict that millions of Americans could lose their health insurance if the bill is enacted in its current form. The bill includes cuts to programs such as Medicaid and the Affordable Care Act in order to fund President Donald Trump’s priorities, including nearly $4 trillion in tax cuts.

According to the Congressional Budget Office (CBO), approximately 11 million people could lose health insurance coverage due to provisions in the bill passed by the House of Representatives. An additional 4 million individuals could lose insurance due to expiring Obamacare subsidies, which the bill does not extend. These changes could result in a significant increase in the number of uninsured Americans.

The “One Big Beautiful Bill Act” may undergo changes as Senate Republicans review it. Health-care cuts have been a contentious issue, with some GOP senators expressing opposition to cuts to Medicaid. The bill is projected to add $2.4 trillion to the national debt over a decade, despite cutting over $900 billion from health-care programs during that time.

Experts note that these cuts represent a significant departure from the trend of increasing access to health insurance over the past 50 years. Alice Burns, associate director of the program on Medicaid and the uninsured at KFF, describes the potential impact of the bill as the “biggest retraction in health insurance that we’ve ever experienced.”

One of the key provisions in the bill is the implementation of work requirements for Medicaid recipients in states that expanded the program under the Affordable Care Act. These requirements would affect individuals aged 19 to 64 who do not have a qualifying exemption, necessitating that they work or participate in qualifying activities for at least 80 hours per month to maintain coverage.

Federal funding cuts to Medicaid are expected to have far-reaching implications, with experts warning that no population is immune to the effects of the bill’s proposed cuts. Allison Orris, senior fellow and director of Medicaid policy at the Center on Budget and Policy Priorities, emphasizes that states will need to adjust to the reductions in funding.

While the House Speaker, Mike Johnson, has defended the work requirements as reasonable, the CBO estimates that these requirements could cause millions of adults to lose federal Medicaid coverage. As the bill continues to be debated in the Senate, the future of health insurance coverage for millions of Americans hangs in the balance. The recent House proposal to change health care coverage in the United States has sparked concerns and debates over its potential impact on millions of Americans. According to the Congressional Budget Office (CBO), this proposal could result in an increase of 4.8 million people without insurance, a number that may actually be higher due to underreporting and paperwork issues for exemptions, as noted by KFF’s Burns.

One of the major challenges presented by this proposal is the funding for state Medicaid programs. States have historically relied on health-care provider taxes to generate revenue for Medicaid, but the House proposal would put a stop to this practice. As a result, states may face difficult decisions such as cutting coverage or other parts of their budget to maintain their Medicaid program. This could lead to cuts in essential services like home- and community-based care to prioritize mandatory benefits like hospital care.

Additionally, the House proposal would delay important eligibility rules for Medicaid until 2035, potentially making it harder for older adults and individuals with disabilities to enroll. States would also see their federal matching rate reduced if they offer coverage to undocumented immigrants, further straining their Medicaid programs.

The Affordable Care Act (ACA) cuts proposed in the legislation are described as “wonky” but “consequential” by experts. More than 24 million people currently have health insurance through the ACA marketplaces, which serve as a crucial source of coverage for those who don’t have access to employer-sponsored insurance. The House legislation could significantly reduce ACA enrollment through various changes, impacting the number of insured individuals.

Another concerning aspect of the proposal is the expiration of ACA subsidies, which have helped lower premiums for households. With the enhanced subsidies set to expire after this year, about 4.2 million people could be uninsured in 2034. This could force individuals to forgo coverage due to affordability issues, while those who remain in marketplace plans may face higher costs without the enhanced subsidies.

Furthermore, the legislation introduces additional red tape to eligibility and enrollment processes, potentially leading to more than 3 million people losing ACA coverage. Changes such as shortening the open enrollment period and requiring enrollees to take action to renew coverage could create barriers for individuals seeking health insurance.

Overall, the House proposal presents significant challenges and potential consequences for the health care system in the United States. As lawmakers continue to debate and refine the legislation, it will be crucial to consider the impact on millions of Americans who rely on Medicaid and ACA coverage for their health care needs. The Affordable Care Act (ACA) has provisions in place to help individuals and families afford health insurance coverage through the use of premium tax credits. However, if a person’s annual income ends up being higher than what they initially estimated when applying for these subsidies, they may be required to repay any excess amount during tax season.

Under current law, there are caps on the amount that some households have to repay. But a new House bill is proposing that all premium tax credit recipients repay the full amount of any excess, regardless of their income level. While this may seem like a fair requirement, experts have raised concerns about the practicality and fairness of this policy.

According to KFF, income for low-income individuals can be unpredictable and fluctuate due to factors like hourly wage jobs, self-employment, or holding multiple jobs. This makes it difficult for them to accurately predict their income for the upcoming year, making it challenging to avoid excess subsidies that would need to be repaid.

Furthermore, the House bill also includes provisions that limit marketplace insurance eligibility for certain groups of legal immigrants. Starting in 2027, many lawfully present immigrants such as refugees, asylees, and individuals with Temporary Protected Status would no longer be eligible for subsidized insurance on ACA exchanges. Additionally, DACA recipients, also known as “Dreamers,” would be barred from purchasing insurance through ACA exchanges in all states.

DACA recipients are currently considered lawfully present for health coverage purposes in 31 states and the District of Columbia, allowing them to enroll in plans and receive subsidies and cost-sharing reductions. However, this new legislation would restrict their access to these benefits, further complicating their ability to afford and access healthcare.

Overall, the proposed changes in the House bill regarding repayment of excess subsidies and curtailment of insurance use by immigrants raise concerns about fairness, practicality, and access to healthcare for vulnerable populations. It is important to consider the implications of these policies on individuals and families who rely on ACA subsidies to afford health insurance coverage.