The housing market was supposed to recover this year. What happened?

At the start of 2025, the housing market seemed poised for a rebound. With inflation easing, a strong economy, and declining mortgage rates, conditions were favorable for buyers and sellers to engage in the market. However, the landscape quickly shifted when President Donald Trump implemented sweeping global trade tariffs on April 2. This move caused mortgage rates to spike, reaching 6.89% by the end of May, the highest level in months. The sudden volatility dampened buyer enthusiasm, leading to a more cautious approach.

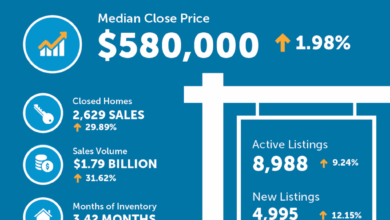

Real estate agents nationwide reported a cooling market, with sellers resistant to price reductions and buyers hesitant to make significant purchases amidst economic uncertainty. Even in areas like Austin, Texas, where prices dropped and inventory increased, homes sat on the market for extended periods. In contrast, competitive markets like the New York City suburbs saw a slowdown in the number of offers on properties.

Despite an increase in housing inventory, buyers remained reluctant, resulting in a stagnant market. Sellers, on the other hand, did not feel pressure to lower prices, as many were locked into historically low mortgage rates. The lack of new housing construction since the foreclosure crisis exacerbated the situation, contributing to high prices and limited supply.

While some regions like Austin experienced a decline in median home prices, buyers perceived the market as overheated and unpredictable. Sellers were more inclined to remove listings rather than reduce prices significantly, leading to a standstill in transactions. Even homeowners like John Huffman and Nan Walsh, who listed their property in East Austin, were in no rush to sell, given their favorable mortgage terms and alternative options.

Overall, the housing market in 2025 faced challenges stemming from economic uncertainty, fluctuating mortgage rates, and a persistent lack of new housing supply. Buyers and sellers navigated a complex landscape, with diverging perspectives on market conditions and future prospects.

This article was originally published in The New York Times.

Stay updated on real estate and business news by subscribing to our weekly newsletter, On the Block.

Original Publication Date: