What Colorado homeowners need to know about insurance rates

Colorado Homeowners Struggle with Rising Home Insurance Costs

Colorado homeowners are feeling the financial strain as home insurance premiums continue to climb. According to a recent report by Insurify, premiums are expected to increase by 11% this year, with the average annual premium reaching $6,630.

The escalating costs are making it increasingly difficult for homeowners to find affordable coverage. A survey conducted by ValuePenguin revealed some alarming statistics:

- In 2024, two-thirds of homeowners experienced premium increases, leading to 25% of insurers dropping them.

- 50% of homeowners are concerned about their homes becoming uninsurable.

- 44% of homeowners find home insurance less affordable compared to previous years, with 75% anticipating further rate hikes in 2025.

- Despite the challenges, many homeowners are taking proactive steps to save on insurance, such as shopping for better rates and asking for discounts.

Growing Number of Uninsured Homeowners

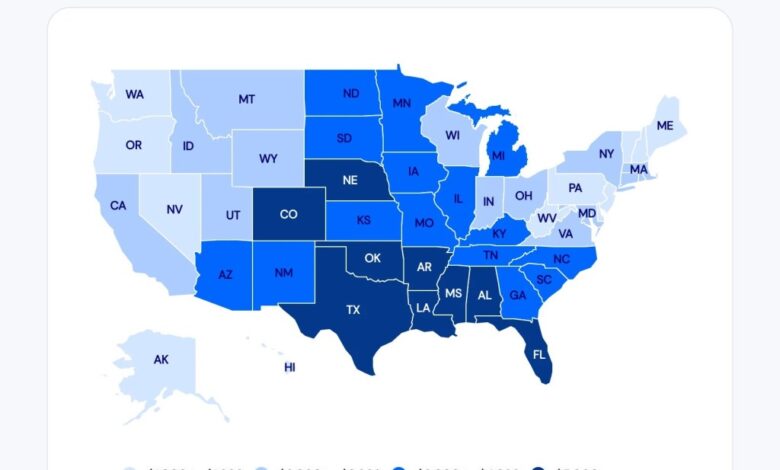

Despite the recent devastating wildfires in California, a study by LendingTree revealed that millions of homeowners across the country remain uninsured. Key findings include:

- Approximately one in seven homes in the U.S. is uninsured, totaling 11.3 million out of 82.9 million owner-occupied homes.

- Colorado has seen a significant 76.6% increase in home insurance rates over the past six years.

- The average annual cost of a homeowners’ insurance policy in Colorado is $3,331, 55% higher than the national average.

- Colorado’s home insurance rates are higher compared to neighboring states like Arizona and Nevada.

Efforts to Address Rising Costs

Colorado is taking steps to address the escalating homeowner insurance costs by implementing a 1% policy fee. This fee aims to increase competition among insurers, enhance homeowner protections, and ultimately lower premiums.