Among the Large-Cap Stocks Insiders and Short Sellers Are Dumping Like Crazy

The U.S. stock market is currently facing a wave of uncertainty, with investors feeling the impact of President Trump’s policies. Insider trading and short selling activities are on the rise, signaling potential red flags for large-cap stocks. In a recent report, we highlighted the top 20 large-cap stocks that insiders and short sellers are abandoning, shedding light on the market sentiment.

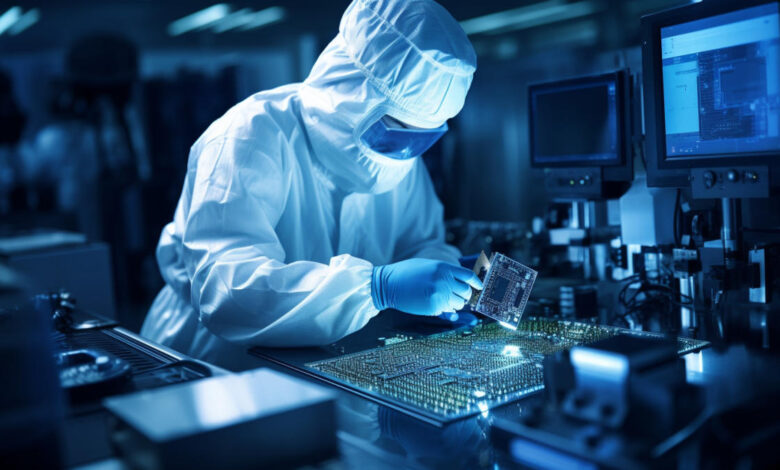

Amidst this backdrop, ON Semiconductor Corporation (NASDAQ:ON) stands out as a company facing challenges in the current market environment. The company, known for its intelligent power and sensing technologies, is grappling with declining regional revenue, particularly in the Japanese market. Factors such as geopolitical uncertainty and slower growth in the electric vehicle segment are contributing to ON Semiconductor’s anticipated revenue decline of 25% in 2025.

Insiders at ON Semiconductor Corporation (NASDAQ:ON) have been selling more than buying, indicating potential concerns about the company’s future performance. Additionally, the company’s short float of 6.98% suggests that speculators are betting against its upside. These factors position ON Semiconductor as the 16th stock on the list of large-cap stocks insiders and short sellers are divesting from.

While ON Semiconductor Corporation (NASDAQ:ON) presents investment opportunities, our focus remains on AI stocks, which have shown greater potential for delivering higher returns in a shorter timeframe. We believe that investing in AI stocks may offer more promising prospects compared to ON Semiconductor. For investors seeking AI stocks with significant growth potential, we recommend exploring our report on the cheapest AI stock currently available.

In conclusion, understanding market dynamics and monitoring insider and short seller activities can provide valuable insights for making informed investment decisions. By staying informed about industry trends and market movements, investors can position themselves for success in a volatile market environment.